Athletes going broke post-retirement is a surprisingly common issue. Despite earning massive salaries during their careers, many professional athletes find themselves in financial trouble after they hang up their boots. After 2 years of retirement, about 78% of NFL players go broke or are under financial stress. All athletes are not millionaires but are spending like they are. The leading issues for pro athletes going broke are lack of financial knowledge and overspending.

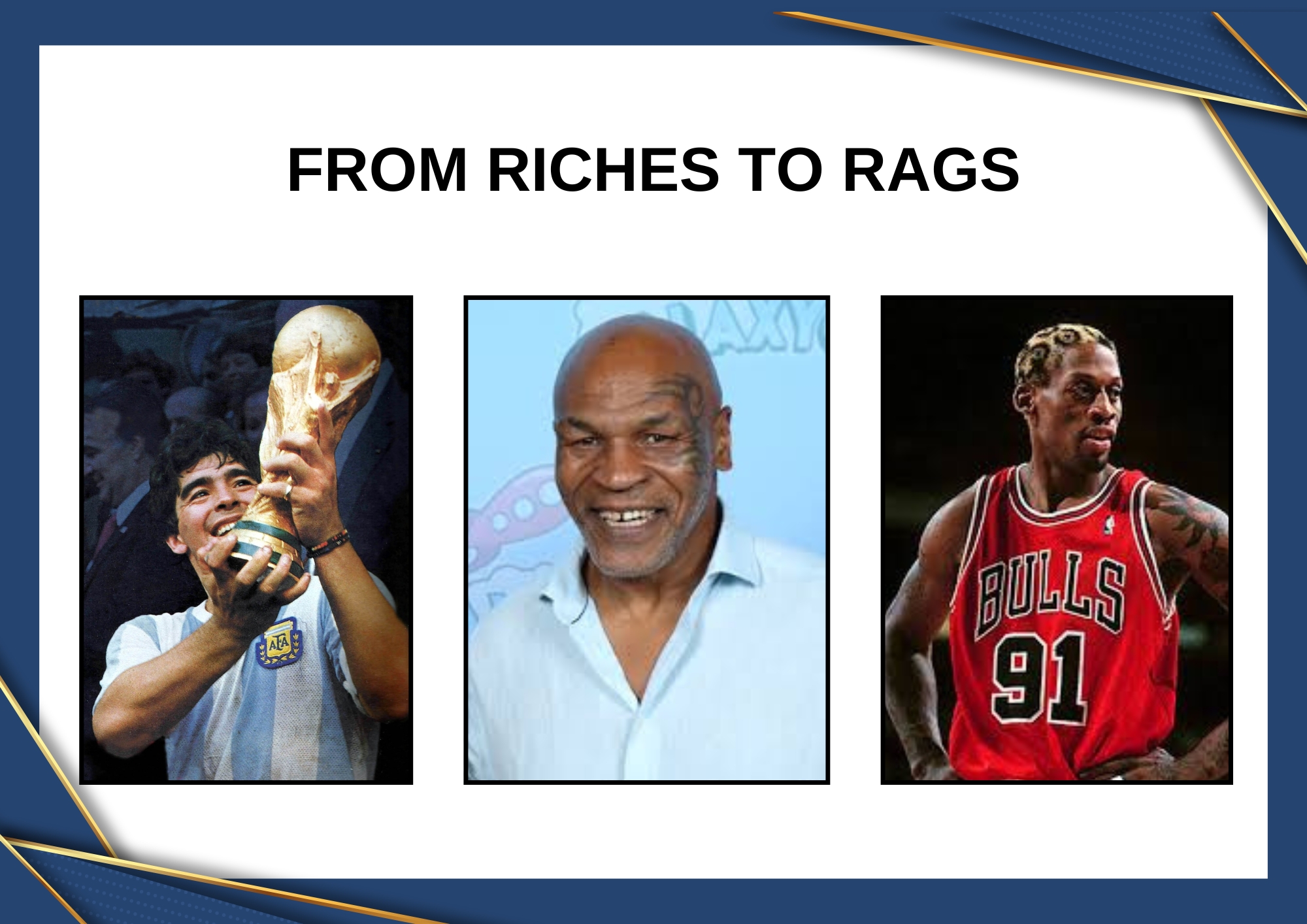

Young athletes who were just selected by professional teams find themselves unexpectedly wealthy and ill-prepared to manage it. After they sign their first contract, they start to believe that the second one is likewise assured, which is how they end up becoming deeply in debt. Using the money from their first contract to purchase pricey homes, elegant cars, and parties; if their second contract is not converted, they will already be deeply in debt. Their lifestyle has drastically changed, even if their second contract is converted, which puts them in a significant debt hole. The former heavyweight boxing champion, Mike Tyson, earned over $300 million during his career but filed for bankruptcy in 2003 due to lavish spending and legal troubles. However, if the player has had a good career, they may end up bankrupt after retirement due to poor financial decisions, expensive commodities, and gambling. When the steady stream of cash stops, they find it difficult to maintain the lifestyle they have been living for the past several years. When their income stops, they gradually begin to fall bankrupt because they are so used to living a life of luxury, shopping at high-end stores, and taking extravagant holidays. However, some athletes frequently put their athletic careers first and might not get enough financial counseling or education in their early years. Like many wealthy people, athletes are susceptible to financial frauds. Athletes risk losing a significant amount of money if they fall for these schemes, which offer large sums of money with no risk. This might occur if people make hazardous investments or fail to diversify their assets. These athletes are vulnerable to falling for con artists and making bad financial decisions. A vulnerability that certain financial advisors may take advantage of is the lack of financial awareness among athletes. These advisors might suggest inappropriate investments that put large commissions ahead of long-term security in an attempt to profit from the athlete’s trust and lack of financial literacy.

Athletes may follow this dangerous path of reckless endeavors and even financial disaster. The NBA Hall of Famer Dennis Rodman made millions of dollars throughout his career, but after he retired, he had trouble paying his debts, including child support and court bills. For an athlete, injuries are the most unanticipated cost, particularly those that end a career. Athletes may have to retire early due to injury, which will reduce their earning potential. Athletes’ earning window is likewise limited because their careers in professional sports are generally shorter than those in other fields. A lot of elite athletes don’t have any ideas about how they’ll make money after they retire.

Professional football player, Diego Maradona had serious financial problems in his later years. There were two primary factors that led to this:

Tax Issues: Maradona allegedly failed to pay taxes on his earnings, which put him in conflict with the Italian government. His finances were severely damaged by an enormous $54 million tax obligation from Italy in 2009, which ultimately led him to file for bankruptcy.

Substance Abuse: Maradona’s cocaine use made his financial circumstances even more difficult. He lost out on sponsorships and his ability to make money after receiving a 15-month suspension from the Italian League due to a positive drug test and subsequent arrest for cocaine use. Even while he denies having a drug problem, these legal troubles surely harmed his pocket.

Diego Maradona tragically departed away in November 2020, but he left behind a lasting impact on and off the field.

Athletes can stay clear of financial troubles by joining financial education programs, seeking expert advisors, and crafting a solid plan for life after sports. Taking these steps helps them make wise financial choices and ensures a successful future beyond their playing careers.

Comments